Nvidia has long been the uncontested leader in the AI GPU market, but a new contender has just emerged. Etched, a two-year-old startup founded by Harvard dropouts, is stepping into the ring to challenge the chipmaking giant’s dominance with substantial funding and a vision to build competitive AI chips.

Today, Etched announced it has secured $120 million in Series A funding to develop a specialized chip for generative AI. The funding was led by Primary Venture Partners, with participation from other high-profile investors including former PayPal CEO Peter Thiel and Replit CEO Amjad Masad.

Although the company hasn’t disclosed its current valuation, Etched was valued at $34 million during its $5.4 million seed round in March 2023. Founded in 2022 by Gavin Uberti and Chris Zhu, the 35-person startup is gearing up to take on the AI chip giant Nvidia.

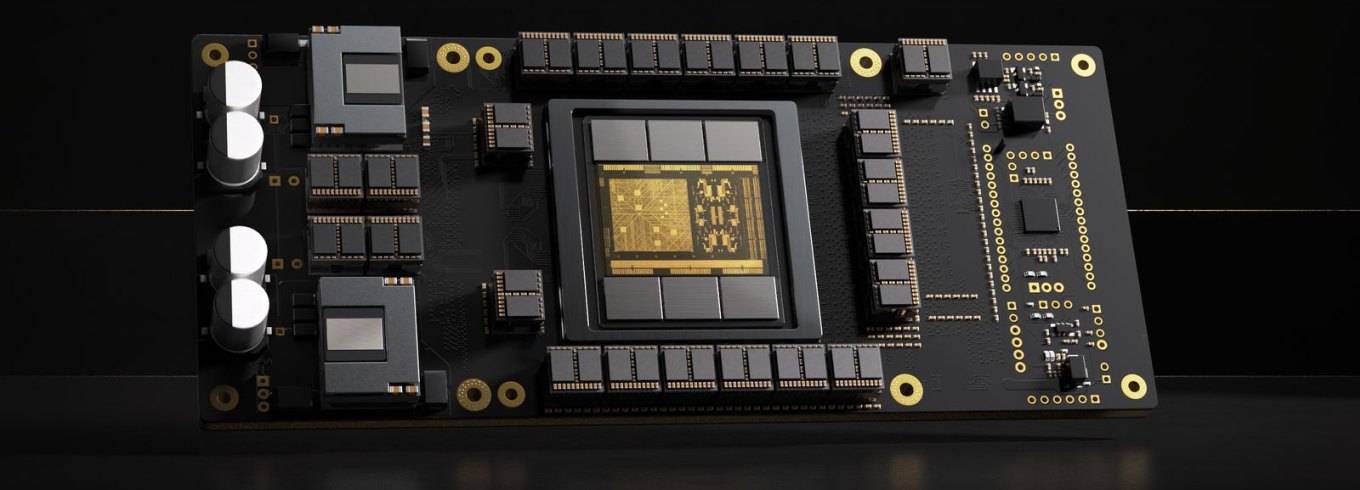

Etched’s first product, the Sohu chip, is designed to train, deploy, and optimize AI models known as transformers. These models form the backbone of advancements like OpenAI’s ChatGPT. To fabricate the chips, Etched has partnered with Taiwan Semiconductor Manufacturing Co. (TSMC). CEO Gavin Uberti emphasized the need for the Series A funding to cover the costly process of “taping out” the chip designs at TSMC.

Sohu, the world’s first transformer ASIC

“This company is a little bit of a bet,” said Uberti in an interview. “If transformers go away, our company will die. But if they stick around, we’re going to be one of the biggest companies of all time.”

Uberti believes that as AI evolves, the demand for power-efficient, customized chips—known as ASICs—will grow. These chips are tailored to execute specific AI models, offering greater efficiency compared to Nvidia’s general-purpose GPUs, which, while versatile, are also more expensive and energy-intensive, CNBC reported.

“We’re making the biggest bet in AI,” Uberti reiterated. “If transformers go away, we’ll die. But if they stick around, we’re the biggest company of all time.”

Nvidia currently dominates the AI chip market, commanding approximately 80% of sales. The company’s general-purpose AI chips are versatile but can consume more energy than ASICs designed for specific functions. Nvidia, the largest U.S. company by market value, has seen its sales triple annually for three consecutive quarters, reaching over $26 billion in the latest period.

Despite Nvidia’s formidable presence and resources, startups like Etched are forging ahead. Primary Venture Partners led the recent funding round, with additional backing from Peter Thiel, Stanley Druckenmiller, and Cruise founder Kyle Vogt.

The AI chip market is attracting significant interest and investment, with other startups like Cerebras Systems and Tenstorrent also vying for a piece of the pie. Cerebras is developing a physically larger AI chip, while Tenstorrent leverages the trendy RISC-V technology.

“The reason we were so excited about what we’re doing, why we dropped out of school and we’ve convinced so many people to leave these chip projects — this is the most important thing to be working on,” said Robert Wachen, Etched’s operating chief. “The entire future of technology is going to be shaped by whether the infrastructure can handle the scale.”

Semiconductors remain one of the toughest industries for startups, requiring long development cycles, significant capital, and collaboration with a limited number of manufacturing partners like TSMC.

Meanwhile, investors continue to pour billions into AI startups as the AI race heats up. In 2023 alone, venture capitalists invested $6 billion in AI semiconductor companies, slightly up from $5.7 billion in 2022, according to PitchBook data.